Home Equity Loans Toronto- secure financial drop-back in a conducive manner

Home Equity Loans Toronto is a type of secured fixed loan in which the borrower avails equity of his/her abode as collateral. The value of the property as decided by the lending institution determines the criterion for equity loan amount. It is equivalent to the second mortgage

Types of Home Equity Loans

Primarily there are two types of Home Equity Loans Toronto.

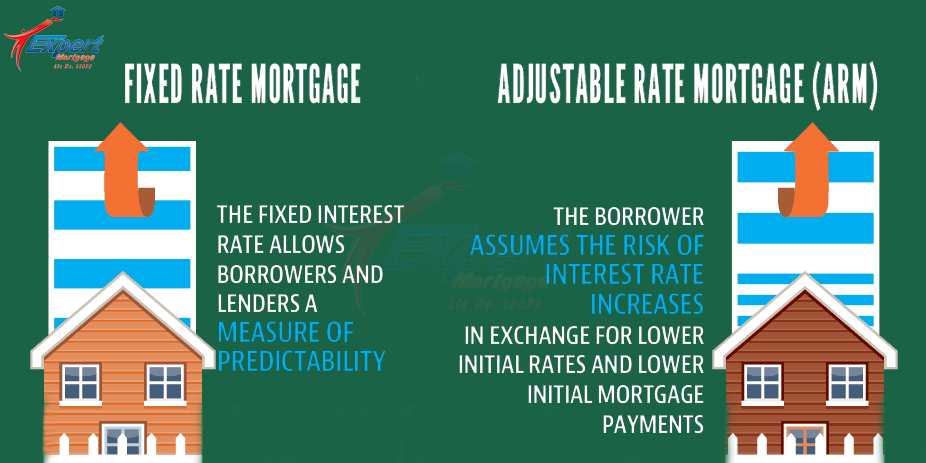

1. Fixed rate loans – they provide a lump-sum to the borrower which needs repayment in fixed time span at a prior set interest rate that cannot vary at any instance

2. Home equity lines of credit (HELOC) – they are the loans with variable interest rates. They have fixed term for repayment of the outstanding amount. Their working is analogous to that of the credit cards

Conditions under which people opt for Home Equity Loans

- Financing education- higher education is quite expensive in certain disciplines if one aspires for a high paying job or a promising career, then the hefty sum of fees equates with the loan amount.

- Home renovations- for exquisite renovations in homestead such as modular kitchen, Jacuzzi, or overall renovation of the abode demand huge sum which in turn add to the value of the equity.

- Business expansion or investment- for setting out a novel business venture, or expanding the current business empire the capital amount required at first instance is procurable through equity loan.

- Medical emergencies- pre-operative medical bills, chronic health issues or the unrelenting, pernicious diseases require massive medical expenses for saving the life of the ailing patient. Equity loans fulfill the dire need of massive amount.

- Debt consolidation- in the case of long piled debts or financial crisis these loans help to resolve the monetary issues facilely. Miscellaneous – purchasing luxury car or exquisite holiday plans account for the assorted reasons of loan application.

Benefits of Home Equity Loans Toronto

- They are procurable at a lower rate of interest.

- Massive loans are easily availed.

- Often the interest payable is tax deductible that accounts to huge benefit.

- Their approval is easy and has simple, facile requirements for application.

Home Equity Loans Toronto emerges as a windfall in case of desperate requirement of a hefty sum. They emerge as a survivor to overcome the pecuniary issues. They proffer prompt cash without plunging into the savings.